WHAT ARE PCI FEES?

PCI COMPLIANCE FEES

PCI NON-COMPLIANCE FEES

WHAT ARE THE REQUIREMENTS FOR COMPLIANCE?

It is crucial that you see compliance as an asset rather than a hindrance in operations or a financial burden. These standards are designed to ensure that your customers’ credit card data is handled safely and securely to minimize any chance of a data breach.

The most important action you must take is to complete the Self-Assessment Questionnaire (SAQ), and this must be updated annually. Merchants are also required to conduct quarterly scans of their system to ensure there are no data breaches. Internal scans can be conducted inhouse, however all external scans must be done by an Authorized Scanning Vendor (ASV). A PCI vulnerability scan is a high-level, automated test that identifies and documents potential network vulnerabilities in an organization. No matter their size, all firms are required by the Payment Card Industry Data Security Standard (PCI DSS) to conduct internal and external network vulnerability scans at least once a quarter and after making any substantial changes to their networks.

Being PCI non-compliant can lead to your organization facing fines of $5,000 to $100,000 from payment processors. In addition to fines, there are a broad range of consequences associated with breaching the regulations, including a suspension from accepting credit cards, liability for fraud charges, and replacement costs.

80% OF ALL MERCHANTS ARE NOT COMPLIANCE

NAUTICAL PAYMENT SOLUTIONS PCI COMPLIANCE ADMINISTRATOR OPTION

WHAT IS AN ISV and how do they differ from an ISO/MSP?

In the payment processing industry, most merchants process payments through a middleman ISO (independent sales organization) also sometimes referred to as an MSP (member service provider). Both are used interchangeably in the

payment industry. Visa calls them “ISOs” and MasterCard calls them “MSPs. They both represent the backend processor and are sales representatives that focus on selling and managing merchant accounts, provide limited support, but they don’t

have direct technical interaction with the actual payment process in most cases. So, most technical support or required assistance will be handled through third-party communication.

An ISV (independent software vendor) on the other hand is a company that develops and sells software solutions to businesses that run on one or more computer hardware or operating system (OS) platforms. In the context of payment processing, ISVs create applications and platforms that integrate payment processing functionality into existing solutions, such as software, point-of-sale (POS) systems, e-commerce platforms or customer relationship management (CRM) tools. By providing seamless payment gateway integration, ISVs have direct access to the backend processor and are responsible for technically maintaining the gateway and the payment process. This enables merchants to accept payments within their existing software infrastructure, improving the overall customer experience. Adding an integrated approach to payments to your software packages could be a game changing move, as it offers a broad range of benefits for end users and merchants like enhanced security and user experience, all of which serves to increase the value of your payment process. Integrated payments are payment processors that are embedded within other software programs used by businesses, such as accounting, customer relationship management (CRM), and specific industry management software. ISVs won’t redirect customers to a third-party payment processor, but process payments via an embedded payment gateway. This means every company will end up with a unique integrated payment system, because each business has specific processing requirements. Integrated payment solutions are designed to streamline payment processing and customer experience, optimizing the back end of operations to keep everything working together in harmony. With Nautical Payment Solution we take ISV duties to the next level in assisting in the PCI Compliance process. We take the payment process seriously with your best interest in mind.

Nautical Payment Solution is a Registered ISV (independent software vendor)

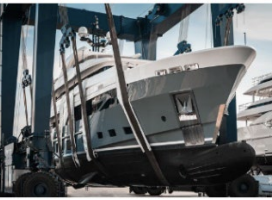

Earning Revenue for the Boating Industry

Marinas

Boatyards

Repair Shops

Dealerships